maryland earned income tax credit 2019

2018 Maryland Earned Income Tax Credit EITC Marylands EITC is a credit for certain taxpayers who have income and have worked. For 2019 the maximum Earned Income Tax Credit per taxpayer is.

The Maryland Earned Income Tax Credit can provide some necessary breathing room as at least one burden can be legitimately reduced.

. Note this is not the same thing as the federal Earned Income Tax Credit EITC. The Earned Income Tax Credit EITC is a benefit for working people with low to moderate income. 2019 Federal Income Tax Receipt Average Federal Income Taxes Paid in Maryland April 15 2020 Inflation adjusted to 2019 dollars.

5828 with two Qualifying Children. If you qualify for the federal earned income tax credit and claim it on your federal return you may be entitled to a Maryland earned income tax credit on the state return equal to 50 of the federal tax credit. AK Burton PC knows the current tax laws and how to work with the IRS.

And you may qualify to receive some of these credits even if you did not earn enough income to be required to file a tax return. You must file your Maryland income tax return on Form 504 and complete through the line for credit for fiduciary income tax paid to another state on the Form 504. Then complete Form 502LC.

You can elect to use your 2019 earned income to figure your 2021 earned income credit EIC if your 2019 earned income is more than your 2021 earned income. Earned Income Tax Credit The Earned Income Tax Credit EITC is a benefit for working people with low to moderate income. Covid protocols if requested.

3526 with one Qualifying Child. See Instruction 21 for more information. The Earned Income Tax Credit also known as Earned Income Credit EIC is a benefit for working people with low to moderate income.

2019 Maryland Earned Income Tax Credit EITC Marylands EITC is a credit for certain taxpayers who have income and have worked. This bill passed by the Maryland General Assembly establishes an individual or business may claim a credit against their Maryland State income tax equal to. These credits can reduce the amount of income tax you owe or increase your income tax refund.

Our office is open. Election to use prior-year earned income. In May 2019 Governor Larry Hogan R signed legislation to significantly increase the size of the states Credit for Child and Dependent Care Expenses expand the income limits and make the credit refundable for single filers with incomes.

Qualify to receive some of these credits even if you did not earn enough income to be required to file a tax return. Married filing jointly Head of Household Qualifying Widower. Qualify to receive some of these credits even if you did not earn enough income to be required to file a tax return.

Line 13 of the Form 502LC is your State tax credit. This is a result of House Bill 856 Acts of 2018 amending the Maryland earned income tax credit to allow an individual without a qualifying child to. Search for jobs related to Maryland earned income tax credit notice 2019 or hire on the worlds largest freelancing marketplace with 20m jobs.

2021 Maryland Earned Income Tax Credit EITC Marylands EITC is a credit for certain taxpayers who have income and have. If you meet the qualifications above on your 2019 Maryland state tax return you should be eligible for. Its free to sign up and bid on jobs.

2019 Maryland Earned Income Tax Credit EITC Marylands EITC is a credit for certain taxpayers who have income and have worked. The state EITC reduces the amount of Maryland tax you owe. If you qualify for the federal earned income tax credit and claim it on your federal return you may be entitled to a Maryland earned income tax credit on the state return equal to 50 of the federal tax credit.

529 with no Qualifying Children. The payment amount is based on your filing status from your 2019 return. 2019 Maryland Average Federal Income Taxes Paid.

Our experienced tax preparers can file your business and personal tax returns and represent you to the IRS. In 2019 86000 Maryland workers paid taxes this way and 60000 of them had incomes low enough that they would have qualified for the tax credit if allowed. The state EITC reduces the amount of Maryland tax you owe.

Taxpayers to indicate they are claiming the Maryland Earned Income Credit but do not qualify for the federal Earned Income Credit. Additionally if an individuals earned income was higher in 2019 than in 2020 one can use the 2019 amount to figure their EITC for 2020. This amount should be entered on Line 1 of the Income Tax Credit Summary section of the Form 502CR.

These credits can reduce the amount of income tax you owe or increase your income tax refund. Call us at 301 365-1974 for a consultation. 2019 Maryland Code Tax - General Title 10 - Income Tax Subtitle 7.

House Bill 482 Acts of 2019. 2018 Maryland Earned Income Tax Credit EITC Marylands EITC is a credit for certain taxpayers who have income and have. There is one modified refundable tax credit available.

50 of the earned income credit allowable for the taxable year under 32 of the Internal Revenue Code. However Maryland does allow you to claim half of the Federal Earned Income Credit amount on Line 22 of your Form 502. See all of the latest requirements for.

Health Includes 8129 for Childrens Health Insurance Program. The earned income tax credit or. Did you receive a letter from the IRS about the EITC.

The state EITC reduces the amount of Maryland tax you owe. The Earned Income Tax Credit EITC helps low- to moderate-income workers and families get a tax break. And you may qualify to receive some of these credits even if you did not earn enough income to be required to file a tax return.

For parents of children up to age five the IRS is paying 3600 per child half as six monthly payments and half as a 2021 tax credit. 6557 with three or more Qualifying Children. Qualify to receive some of these credits even if you did not earn enough income to be required to file a tax return.

This temporary relief is provided through the Taxpayer. Earned income includes all the taxable income and wages you get from working for someone else yourself or from a business or farm you own. If you qualify you can use the credit to reduce the taxes you owe and maybe increase your refund.

A resident may claim a credit against the State income tax for a taxable year in the amount determined under subsection b of this section for earned income.

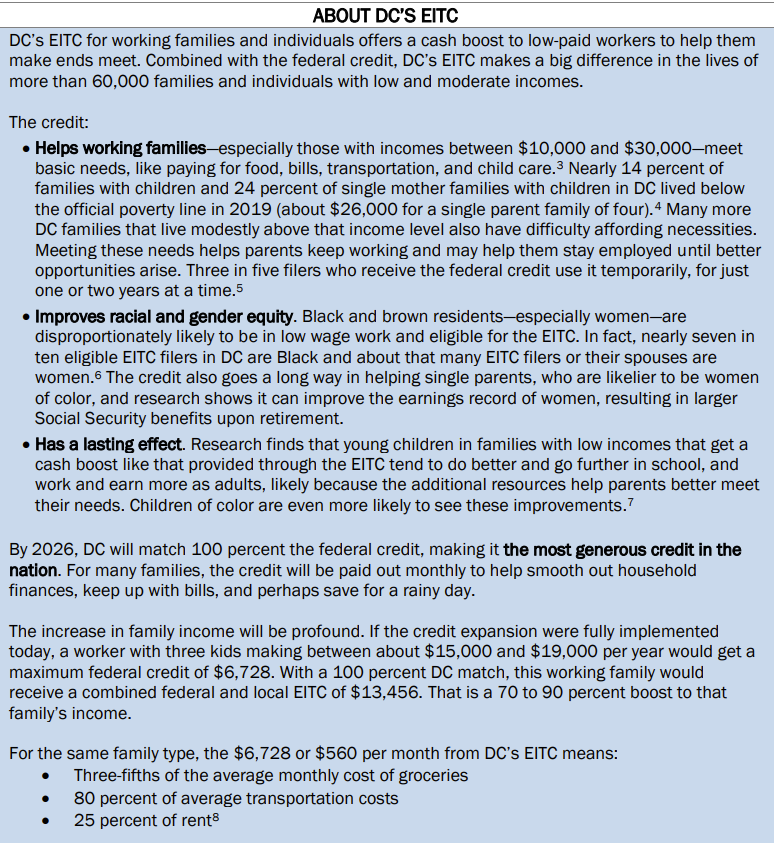

Dc S Earned Income Tax Credit The Most Generous In The Nation But Not The Most Inclusive

What Are The Major Federal Payroll Taxes And How Much Money Do They Raise Tax Policy Center

Dc S Earned Income Tax Credit The Most Generous In The Nation But Not The Most Inclusive

Details Of House Democrats Cash Payments And Tax Credit Expansions Itep

How Does The Deduction For State And Local Taxes Work Tax Policy Center

How Does The Deduction For State And Local Taxes Work Tax Policy Center

How Does The Deduction For State And Local Taxes Work Tax Policy Center

State Income Taxes And Racial Equity Narrowing Racial Income And Wealth Gaps With State Personal Income Taxes Itep

Eligible Taxpayers Can Claim Earned Income Tax Credit Eitc

Earned Income Credit H R Block

/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-01-c5d6697fa005491f8a0049780f7c2b82.jpg)

What Tax Breaks Are Afforded To A Qualifying Widow

Filing Maryland State Taxes Things To Know Credit Karma Tax

Dc S Earned Income Tax Credit The Most Generous In The Nation But Not The Most Inclusive

Earned Income Tax Credit Eitc Tax Credit Amounts Limits

/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-01-c5d6697fa005491f8a0049780f7c2b82.jpg)